[Personal Finance] What Wealthy Blacks Can Teach Us About Investing

An Intimate Look At How Race & Culture Influence Our Investment Choices

By: Stacey Tisdale

It’s important to consider the historic aspect of the place homeownership holds in Black culture. Owning land is what many of our forefathers experienced as the only way to gain wealth, conditioning many of their children to believe the same.

While experience and evolution have breathed space around those deep-seated beliefs – Black millennials are entering the stock market at a higher rate than any other group in the United States – changing attitudes about where to park wealth is a challenge for many.

The Investing Habits of Wealthy Blacks

Wealthy Blacks and Real Estate

Even when it comes to investments other than their primary home, affluent Blacks have tended to move towards real estate.

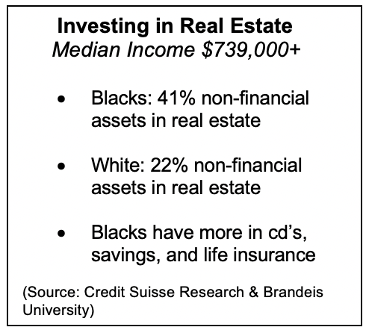

Those with a median income of $739,000 or more invest 41 percent of their non-financial assets in real estate, compared to just 22 percent of Whites in the same income bracket.

The researchers who conducted the study concluded that this more conservative approach of the top 5% of African Americans to investing is understandable when looking at the constrained social mobility trends of the community, and the lower levels of overall economic security.

Socioeconomic disadvantages like predatory lending practices and other historic events have left some Blacks distrustful of the financial services industry.

In addition, many Blacks who fall in the top wealth categories are the first generation of wealth – which may also lead to a cautious approach to investing.

[Are Your Early Lessons About Money Hurting You Now? Read THIS to Find Out]

Lessons Learned

The 2008 financial crisis was a financial disaster for many Americans – particularly those in the Black community - because the vast majority had their net worth locked up in their primary residence.

Analysts say that’s one of the reasons we are seeing more Blacks, particularly millennials and Gen Z, diversify their investment holdings into assets like stocks. Case in point, Black Americans invested in the stock market 3 times more than white Americans last year, according to an Ariel Investment and Charles Schwab survey.

In addition, 70 percent of Black millennials under the age of 40, earning at least $50,000 a year invest in stocks.

[ Angela Yee, On The Importance of Knowing Your Worth. Click HERE.]

What Happens to Wealthy Black Men

Blacks experience affluence, and its financial benefits differently than other groups, particularly Black men.

Researchers at Stanford & Harvard Universities, working with the Census Bureau, conducted a sweeping study that traced the lives of millions of children and found that Black Boys raised in America, even in the wealthiest families, earn less in adulthood than White boys with similar backgrounds

Researchers concluded that if this inequality cannot be explained by individual or household traits, much of what matters probably lies outside the home — in surrounding neighborhoods, in the economy and in a society that views black boys differently from White boys, and even from black girls – as Black women do not experience this same dynamic.

Some of the researchers even went so far as to say that what happens to these affluent Black boys and men is the major cause of the wealth gap.

[Click HERE to get our free, Weekly Wealth Builder Newsletter]

Building Wealth

These socioeconomic tragedies make investing even more imperative for the Black community. The financial markets can help us empower ourselves and level our own economic playing fields.

The world is changing in every way. Political and economic structures are changing. Long-standing racial, religious, and gender stereotypes are being disrupted. This is forcing many of us to take a long, hard look inside, and take personal responsibility for patterns that no longer serve our well-being.

Money’s greatest gift is that it can reflect back to us where we are not using our resources in ways that reflect our highest ideals and values.